Updated - Loans and Cash Support to Businesses under the CARES Act

Client Advisories

Hughes Hubbard & Reed LLP • A New York Limited Liability Partnership

One Battery Park Plaza • New York, New York 10004-1482 • +1 (212) 837-6000

Attorney advertising. This advisory is for informational purposes only and is not intended as legal advice. Prior results do not guarantee a similar outcome. For more information: https://www.hugheshubbard.com/legal-notices.

March 27, 2020 - On March 25, 2020, the US Senate passed a bill for the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”), which includes the Keeping American Workers Paid and Employed Act of 2020 and the Coronavirus Economic Stabilization Act of 2020. The Cares Act was approved by the House of Representatives and signed into law by President Trump on March 27, 2020. This alert summarizes the key provisions of the Cares Act that relate to the extension of loans and cash support to businesses impacted by COVID-19. It updates our prior alerts dated March 27 and March 30 regarding the Paycheck Protection Program, based on the additional guidance and the new application form issued by the U.S. Treasury's on April 3, 2020 (detailed below).

Keeping American Workers Paid and Employed Act of 2020

Under Title I of the CARES Act, the Keeping American Workers Paid and Employed Act of 2020 (the “KAWP Act”), the Small Business Administration may grant up to $349 billion in loans to small businesses between February 15, 2020 and June 30, 2020 under Section 7(a) of the Small Business Act - (the "Paycheck Protection Program"). The Paycheck Protection Program specifically provides eligibility criteria for loan forgiveness, closely linked to retention of employees and maintenance of payroll (as further set forth below).

Paycheck Protection Program

- The Paycheck Protection Program is intended to provide 100% federally guaranteed loans to small businesses that can be forgiven in accordance with the terms noted below. Small businesses also include nonprofit organizations, veteran’s organizations, or tribal businesses.

- Businesses can apply for loans under this program through June 30, 2020 at a bank that is approved for a Section 7(a) loan program (at http://home.treasury.gov/system/files/136/Paycheck-Protection-Program-Application-3-30-2020-v3.pdf). Applications should be submitted early, as they will be analyzed on a "first come, first serve basis" and it's possible that the $349 billion total amount available might run out prior to the deadline.

- Entities who are owned by non-US citizens or non-US residents are still eligible to apply for a loan (previous required certification as to all 20% owners being U.S. citizens has been removed).

- Loan recipients would be small businesses with 500 employees (including full time and part-time employees) or less, as well as businesses from the hospitality and dining industries with more than 500 employees, as long as there are not more than 500 employees in any one location. The SBA retains the ability to set different thresholds for certain industries.

- According to SBA guidelines, only employees whose principal place of residence is in the United States will count for the 500-employee threshold. Independent contractors providing services to an applicant will not count towards such applicant's employee calculation, as they are also eligible for themselves.

- Affiliation provisions are waived for (i) franchises, (ii) businesses from the accommodation and food services sectors with up to 500 employees, and (iii) recipients of financial assistance from licensed small business investment companies.

- Otherwise, affiliated entities would be aggregated for purposed of determining compliance with the below 500-employee requirement, which precludes private equity and venture capital funds from qualifying for assistance for their portfolio companies under common control (if they aggregate above 500 employees). Lobbyists are stull pushing to loosen the affiliation provision under the Paycheck Protection Program, but there has been no change yet on this requirement.

- The loan agreement must certify that (i) the small business is affected by current economic conditions, and (ii) funds will be used to retain workers and maintain payroll or make mortgage payments. At least 75% of the funds are to be used for payroll.

- The loan amount may not exceed $10 million and will be the lesser of:

- 2.5 times the average total monthly payroll costs incurred in the one-year period before the loan is granted (or for seasonal employers the average monthly payroll costs for the 12-week period beginning on February 15, 2020, or from March 1, 2019 to June 30, 2019); plus

- the outstanding amount of a loan made under Section 7(b) of the Small Business Administration Act between January 31, 2020 and the date on which such loan may be refinanced under the covered loan: or,

- upon request, for businesses that were not in existence during the period from February 15, 2019 to June 30, 2019, 2.5 times the average total monthly payroll payments from January 1, 2020 to February 29, 2020; plus

- the outstanding amount of a loan made under Section 7(b) of the Small Business Administration Act between January 31, 2020 and the date on which such loan may be refinanced under the covered loan.

- The loan amount calculation is subject to a detailed analysis. As an example, any compensation paid to an employee in excess of an annual salary of $100,000 should be excluded from the total payroll cost calculation.

- Interest rate will be a 1.00% fixed rate and all customary SBA loan fees are waived.

- Principal, interest and fee payments will be deferred for the first six months, but interest accrues during such period. There is no prepayment penalty.

- The term of the loan will be two years.

- No collateral or personal guarantee may be required as a condition for a loan.

- Loan Forgiveness: A recipient of a loan is eligible for forgiveness in an amount equal to the sum of all payroll costs (including for tipped employees), payments of interest on any mortgage obligation, payments on any rent obligations, and utility payments, provided, that:

- such costs are incurred or such payments are made within 8 weeks of origination of the applicable loan;

- such mortgage, lease or utility services began before February 15, 2020;

- the amount of forgiveness will not exceed the principal amount of the loan;

- the loan’s maturity date may be no more than 10 years after the date of application for loan forgiveness;

- the amount of forgiveness will be reduced by a formula tied to reductions in full time employees (subject to cure by June 30); and

- the amount of forgiveness will be reduced by any cut in total salary or wages of any employee (other than highly compensated employees, see below) during the covered period that is in excess of 25% of the total salary or wages of such employee during the most recent full quarter in which he was employed (subject to cure by June 30).

- There would be no reduction for any employee that received wages or salary at an annualized rate above $100,000 during any 2019 pay period.

Loan Guaranty Program

- Maximum loan amounts under the Small Business’ Express Loan Program were increased from $350,000 to $1,000,000.

- The KAWP Act also expands the allowable uses under Section 7(a) of the Small Business Administration Act loan in order to allow for:

- paid sick leave to employees unable to work due to direct effect of COVID-19;

- maintaining payroll to retain employees during business disruptions and slowdowns;

- meeting increased costs to obtain unavailable materials due to interrupted supply chains; and

- making rent or mortgage payments.

Entrepreneurial Development

- The KAWP Act also designates grants for segments which offer counseling, training, and related assistance to small businesses harmed by COVID-19 in the following amounts:

- $240 million for SBA Small Business Development Centers and Women’s Business Centers and, with respect to such funds, the matching requirement related to obtaining cash contributions from non-Federal sources under the Small Business Act is waived;

- $10 million for the Minority Business Development Agency’s Minority Businesses Centers; and

- $25 million for grants to associates representing resource partners, dedicated to the establishment of centralized hubs for COVID-19 information.

Coronavirus Economic Stabilization Act of 2020

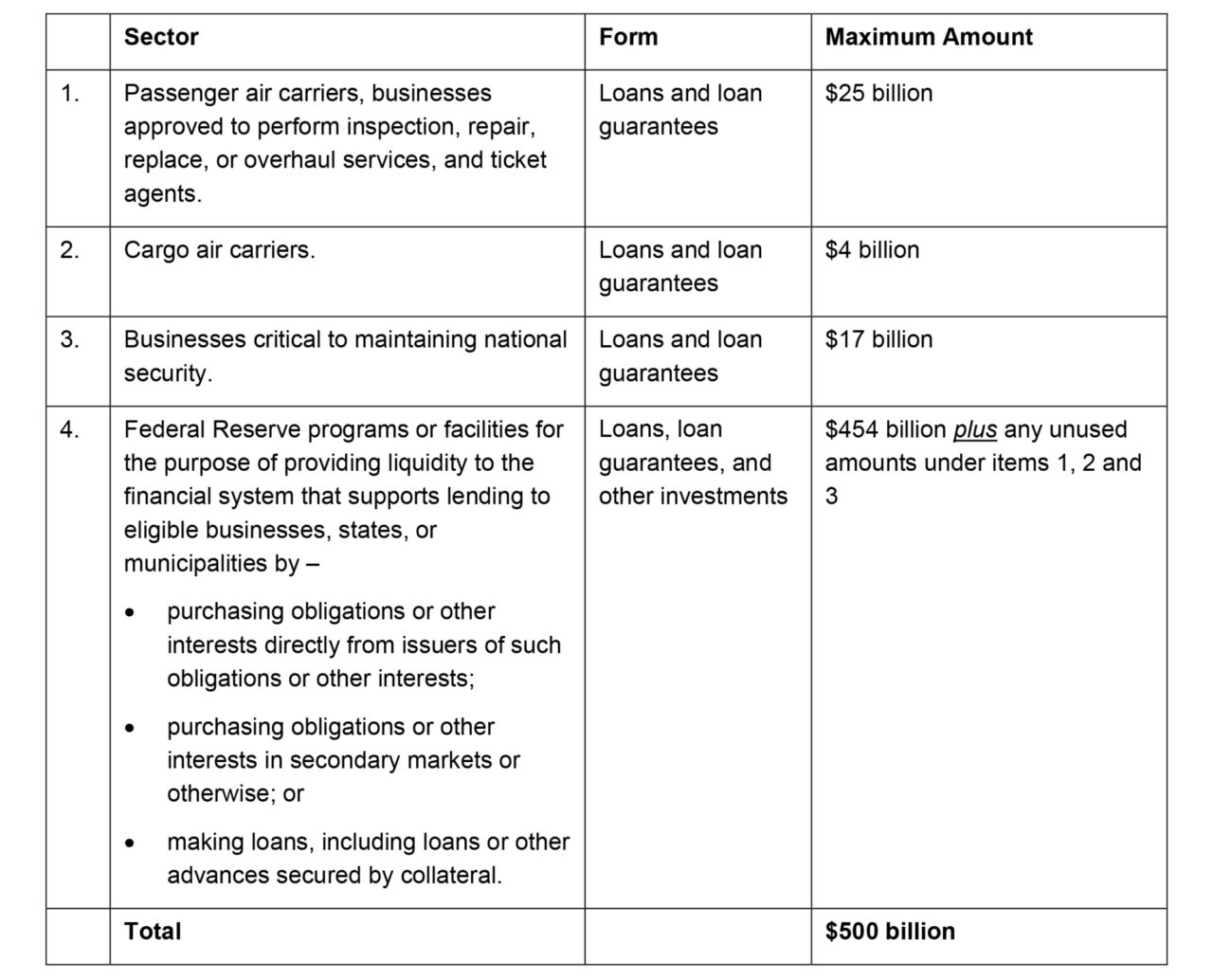

Title IV of the CARES Act, the Coronavirus Economic Stabilization Act of 2020 (the “CES Act”), authorizes the Secretary of Treasury to make up to $500 billion in loans, guarantees and investments to eligible businesses, states, and municipalities.

- The $500 billion authorized under the CES Act will be distributed in the following manner:

- Eligible businessesfor purposes of the programs contemplated by the CES Act consist of (i) air carriers, and (ii) other U.S. businesses that have not otherwise received adequate economic relief in the form of the loans or loan guarantees provided under the CARES Act (each, an “Eligible Business”).

- All loans, loan guarantees, and other investments made to Eligible Businesses pursuant to Items 1, 2 and 3 in the table above, must be subject to the following conditions:

- the Eligible Business must be organized in the U.S., and have significant operations in and a majority of its employees based in the U.S.;

- until 12 months after the loan or loan guarantee is repaid (the “Restricted Period”), stock buybacks are prohibited (the prohibition applies to the stock of the Eligible Business and of its parent companies; stock buybacks pursuant to pre-CARES Act contractual obligations are excluded);

- for the duration of the Restricted Period, dividend payments and other capital distributions are prohibited (the prohibition applies to the common stock of the Eligible Business);

- until September 30, 2020, the Eligible Business may not reduce its employment levels by more than 10 percent from the existing levels as of March 24, 2020;

- for the duration of the Restricted Period, compensation levels to highly compensated officers and employees are subject to the following limitations:

- an individual whose total compensation in 2019 exceeded $425,000, (a) may not receive during any 12 consecutive months more than the total compensation received by such individual in 2019, and (b) may not receive severance or termination benefits in excess of twice the total compensation received by such individual in 2019; and

- an individual whose total compensation in 2019 exceeded $3,000,000 may not receive during any 12 consecutive months more than the sum of $3,000,000 plus 50% of any excess over $3,000,000 received by such individual in 2019.

- In addition, the CES Act prescribes the following terms and conditions with respect to loans and loan guarantees made pursuant to Items 1, 2 and 3 in the table above

- the Eligible Business must have incurred, or is expected to incur, losses that jeopardize its continued operations, and credit is not otherwise reasonably available;

- the loan or loan guarantee will be for the shortest term practicable, and in any case no longer than five years;

- the loan or loan guarantee is either (i) sufficiently secured, or (ii) reflects the risk and, to the extent practicable, is based on market conditions for comparable obligations prevalent prior to the outbreak of COVID-19; and

- if the Eligible Business has issued securities that are traded on a national securities exchange, it must issue to the Secretary of Treasury a warrant or equity interests providing for reasonable equity appreciation, or if such issuance is not feasible, the Secretary may accept a senior debt instrument in an amount and on terms the Secretary deems appropriate. In the case of all other Eligible Businesses (privately held entities), they must issue to the Secretary of Treasury, at the Secretary's discretion (i) a warrant or equity of interests providing for reasonable equity appreciation; or (ii) a senior debt instrument providing for a reasonable interest rate premium.

- The Secretary of Treasury is also instructed to implement a program or facility pursuant to Item 4 of the table above offering financing to banks and other lenders to make loans to businesses employing between 500 and 10,000 employees, at a reduced interest rate of up to 2% per annum and with a grace period for the first 6 months.

- Borrowers would need to certify in good faith as to a number of representations and future looking covenants, including its need for the loan, intended retention of 90% of employees, no dividends, no outsourcing offshore and certain pro-union restrictions.

- Detailed procedures for application and minimum requirements will be published by the Secretary of Treasury within 10 days of the CARES Act’s enactment.